The most basic pricing principle in the world for natural diamonds, whether fancy colors or colorless, states that the rarer the diamond, the higher its value. There is no predetermined linear scale that gradually dictates the price of diamonds. Each diamond has its own unique characteristics and its price will be determined according to its regularity or rarity.

Pink diamonds are among the rarest diamonds and are currently mined primarily at the Argyle mine in Australia, owned by the world’s largest diamond mining company. Argyle is estimated to be responsible for a minimum of 90% of all pink diamonds released annually worldwide which due to the problem of finding natural pink diamonds (only 40-50 carats per year), it’s expected to cease operations last year 2020.

The closure of the Argyle mine is expected to further increase the already high prices of pink diamonds. Some will see this as a hardship and obstacle to their pink dream (mostly investors), and others will see it as a great opportunity to invest in a property with high returns.

How rare are pink diamonds?

When you break down the numbers and dive into the stats, the rarity of pink diamonds becomes immediately apparent, and this explains their high price, rising value, and the influx of investors and collectors to auction houses and websites that sell pink diamonds online.

If we compare the shortage of pink diamonds with the rest of diamonds on the market, we see the following image: Each year between 12 and 14 million carats of diamonds are mined, polished and sold, of which only 0.01 percent are elegant colored diamonds. Of that 0.01%, approximately 80% are brown or yellow diamonds, and also the remaining 20% are gray or black diamonds.

Are pink diamonds a good investment?

In the past, the pinkest diamonds were bought to decorate engagement rings, but steady market indices showing an average increase of 20% each year led to the influx of Self-Managed Superfunds (SMSFs) and wealthy investors from China and the world., which make pink diamonds a financial investment that lacks excitement or romance, but is loaded with realistic considerations of stability, low risk, and positive return.

For those that want to shop for pink diamonds for investment purposes, like SMSF funds, banks and wealthy investors, this is often a ‘safe haven’ that provides all the advantages and benefits of the investment world with small stones that can be transported easily. in your wallet or on your finger, and whose value is sometimes even higher than that of real estate, making it more attractive to many.

The 6 main parameters that influence the price of pink diamonds

1. Origin

The first and supposedly obvious parameter is the origin: is the pink diamond natural or is it created in the laboratory? Today, because of high demand and low supply, there are technological means to artificially create the pink tint in colorless natural diamonds through high and warmth processes.

Natural pink diamonds are significantly more valuable than their man-made counterparts, but an inexperienced eye without the proper equipment will not be able to distinguish between the two. The advanced gemological institutes, directed by the GIA, have the appropriate means and experts who can identify and categorize the characteristics of the diamond, mainly its origin.

Don’t be tempted to buy a pink diamond without a certificate from a leading gemological institute. This is the best guarantee that you are making an informed purchase.

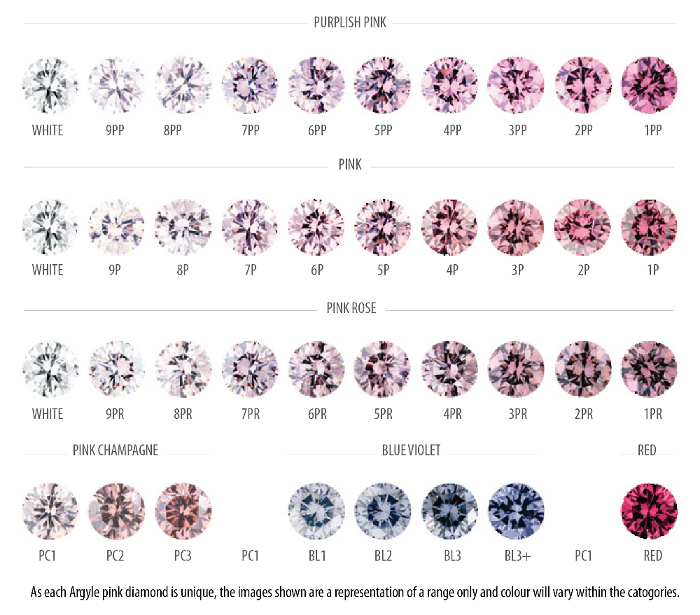

2. Color

The second parameter that influences the price of a pink diamond is its color, that is, the exact definition of the color determined by the gemological institute, taking into account the hue, saturation and hue of the diamond and formulating an agreed description of the basis from which the diamond can be valued.

The rarest and most valuable colors are, of course, the most vivid, deep, and powerful. Elegant hot pink, elegant pink, elegant pink, and elegant hot pink will be priced much higher than their brighter counterparts: soft pink, very light pink, and light pink.

Pure pink diamonds, those without a secondary hue, are considered very rare and therefore very expensive, but if they have a rare secondary hue like violet, their price is expected to rise further. On the opposite hand, if the diamond includes a secondary shade of a less rare color, like brown, its value is probably going to decrease.

3. Carats

Although carat is commonly thought of as representing the size of the diamond, it actually refers specifically to the weight of the diamond. A 1 carat pink diamond that weighs 200 milligrams or 0.2 grams. A 5 carat pink diamond weighs only one gram. Heavier diamonds are also considered rarer and so the price per carat will significantly increase.

4. Clarity

The clarity parameter, which indicates the quality of the reflection and the brilliance of the diamond, as well as the number of internal or external defects, has a significant but less dramatic effect on the price compared to the previous three parameters that we discussed.

Simply compare a pink diamond with clarity level of I3 with a pink diamond of VS1 level and you will understand the difference in terms of brilliance, brilliance and light penetration into the diamond. A diamond with few or no defects, in addition to being of higher quality, is considered rarer and therefore more expensive.

5. Cut

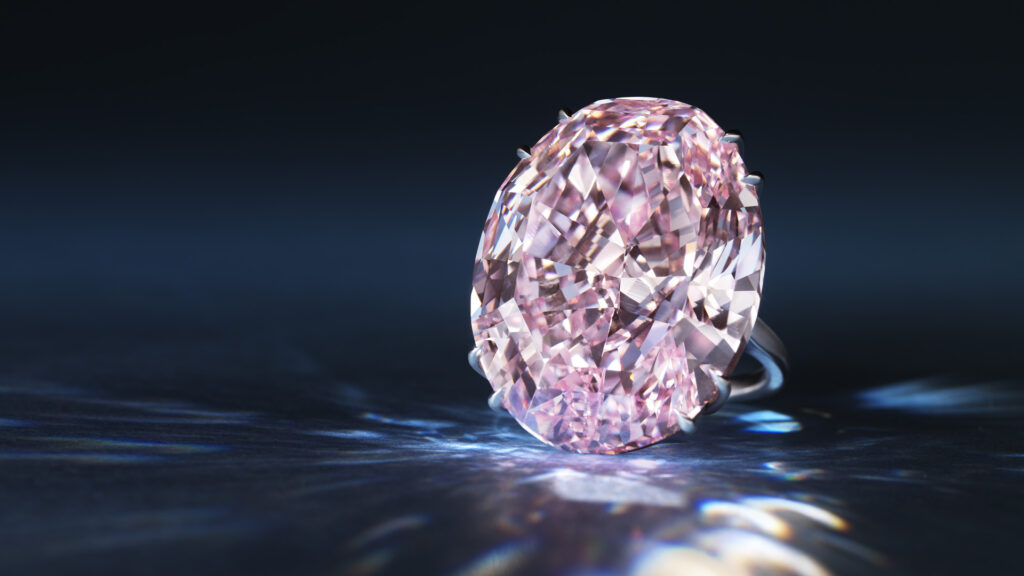

The effect of the cut on the value of the diamond is reflected within the quality of the work done by the polisher to bring out the rarer and valued qualities of the diamond. Is its shape symmetrical? Does it accentuate and deepen its color? Does it seem bigger than its actual weight? Is the enamel shiny and the diamond sparkling and dazzling? If the answer is yes, it implies that the pink diamond you like to purchase has been treated with care by an expert polisher who raises its value by presenting the best and rarest quality finish. If you answered no, it means that the polish will reduce the value of the diamond and make it more difficult to sell.

6. Shape

The shape parameter would presumably be included in the cut parameter, but unlike cut, which refers to the work on the inside of the diamond, “shape” refers to its external and general shape as seen from above and thus therefore, it is considered a separate parameter.

The chosen shape of the diamond affects the way the light is reflected and accentuates the color of the diamond. Therefore, the shape, which is widely utilized in white diamonds due to the big amount of light it contains, isn’t suitable for fancy colored diamonds because it “illuminates” their color while the objective is the opposite.

A few words from Argyle Diamond Investments on Pink Diamonds

We could elaborate and tell you much more about pink diamond prices and investment opportunities, and we promise to do so in future guides. But in the meantime, we will be inviting you to contact us personally, and enjoy the highest level of our professional services on the way to your next pink diamond purchase.

Argyle Diamond Investments offers pink diamonds for sale in a variety of intensities, weights, and shapes. We can invite you to use our advanced search bar to explore and find your own desired pink diamond.

You may also like to read: Invest in pink diamonds: all you need to know